2024 hasn’t been an easy year for mortgage brokers. With mortgage rates climbing and home prices staying high, the market has been tough for buyers and real estate investors. It’s no surprise that mortgage activity hit a 30-year low in 2023, with just 4.3 million loans originated.

In a market like this, standing out from the competition is everything—and that’s where search engine optimization (SEO) can be a game-changer.

Sure, you’ve probably heard stories of businesses pouring thousands into SEO. But here’s the thing: companies invest millions in SEO annually for one simple reason—it works.

Why? Because 92% of homebuyers use the Internet as their primary resource during their search. Mastering SEO means you’ll show up when potential clients actively seek help with mortgage services. It’s not just about being visible; it’s about dominating your local market, connecting with the right clients, and leaving competitors in the dust.

In this guide, we’ll walk you through everything you need to know to start using SEO as a mortgage broker—whether you’re hiring a pro or planning to do it yourself. Let’s get started!

What is Mortgage Broker SEO?

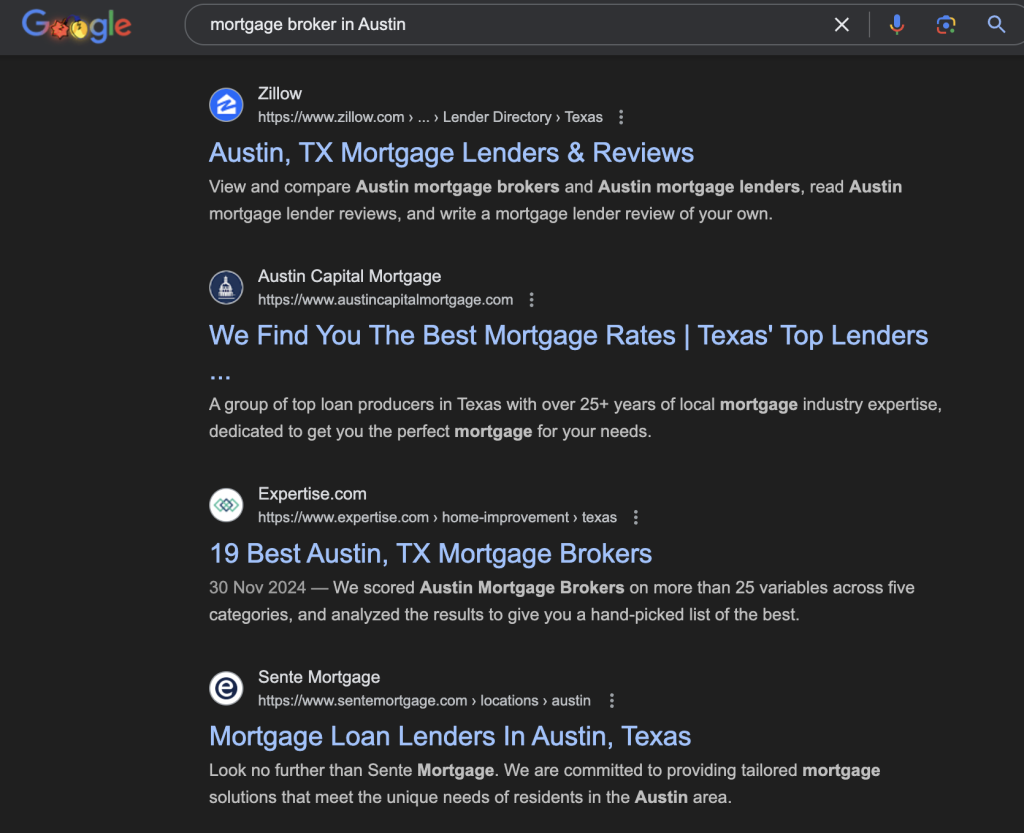

Mortgage broker SEO (Search Engine Optimization) is optimizing your website and online presence so potential clients can easily find you on search engines like Google. It ensures that when someone searches for terms like “mortgage broker Austin” or “how to get a home loan,” your business is front and center:

Source: Google

But here’s the unique thing about SEO for mortgage brokers: it’s not just about visibility—it’s about standing out in a competitive market where differentiation can be challenging. Many brokers offer similar services, so how do you prove you’re the right choice? This is where SEO shines.

By leveraging SEO, especially content marketing, mortgage brokers can highlight their knowledge, expertise, and specialization. Writing helpful, niche-specific content—whether about FHA loans, the mortgage pre-approval process, or refinancing in a specific city—shows potential clients that you truly understand their needs. This not only attracts qualified traffic but also builds trust with your audience.

If you specialize in a particular mortgage, property, or market type, SEO allows you to amplify that expertise and reach the right audience. It positions your company as the go-to authority in your sector of the mortgage industry.

Some key components of mortgage broker SEO include:

Keyword optimization

Researching and using phrases your ideal clients are searching for, like “mortgage brokers for investment properties” or “low-interest first-time homebuyer loans.”

Local SEO

Ensuring you rank highly for location-specific searches like “mortgage brokers in [city].” This includes optimizing your Google Business Profile, using local keywords, and securing local directory listings.

Content creation

Publishing valuable resources—blogs, FAQs, mortgage calculators, or market insights—that demonstrate your expertise and address common client questions. Content also lets you showcase your niche knowledge, helping your mortgage business stand out from competitors.

Technical SEO

This involves making your mortgage website fast, mobile-friendly, and easy to navigate so users and search engines have a great experience.

Link building

Earning backlinks from trusted websites boosts the authority of your mortgage website and helps your site rank higher in search results.

What Kind of ROI Can You Expect from SEO for Mortgage Brokers?

Why should mortgage brokers invest in SEO? The answer is clear—the ROI speaks for itself.

Let’s break it down: the search term “mortgage” gets around 133,000 monthly searches.

Now, imagine your website sitting pretty at the top of those results. You can expect to get around 30% of that traffic, meaning 39,900 leads every month.

Most of these won’t convert, so let’s say 2% become deals—that’s 798.

As you know, not every deal goes through, so let’s assume a 5% drop off. That leaves you with 758 solid leads.

The average mortgage is $146,690, and with a 2% commission, that’s $2,934 per deal.

Now, do the math:

🔣758 leads x $2,934 per mortgage = over $2.2 million in potential monthly earnings.

Even if you’re investing $10,000 per month in SEO, the ROI is off the charts. SEO isn’t just a strategy for mortgage brokers—it’s a game-changer.

Factors that impact ROI

While SEO is a long-term marketing strategy, its ROI depends on a few key factors:

⚠️Competition: Highly competitive markets may require more time and effort to achieve top rankings, but the rewards are proportionally higher.

⚠️Starting point: If your website is already optimized, you may see faster results. Sites with technical issues or penalties might need upfront investment to address the foundational problems.

⚠️SEO budget: A larger budget allows for a more aggressive strategy, accelerating your progress and results.

How to Get Started with Mortgage Broker SEO

Sign up for local citations

As a mortgage broker, your focus is on helping clients in specific areas find the best mortgage deals. Listing your business on industry directories like Zillow, LendingTree, and Bankrate makes it easier for local clients to find you and signals to search engines that your business is legitimate and locally relevant.

Google Business

Google Business is one of the most important local citations—it puts your business on the map. A fully optimized profile boosts your local SEO, increasing your chances of appearing in the “Local Pack” at the top of local search rankings.

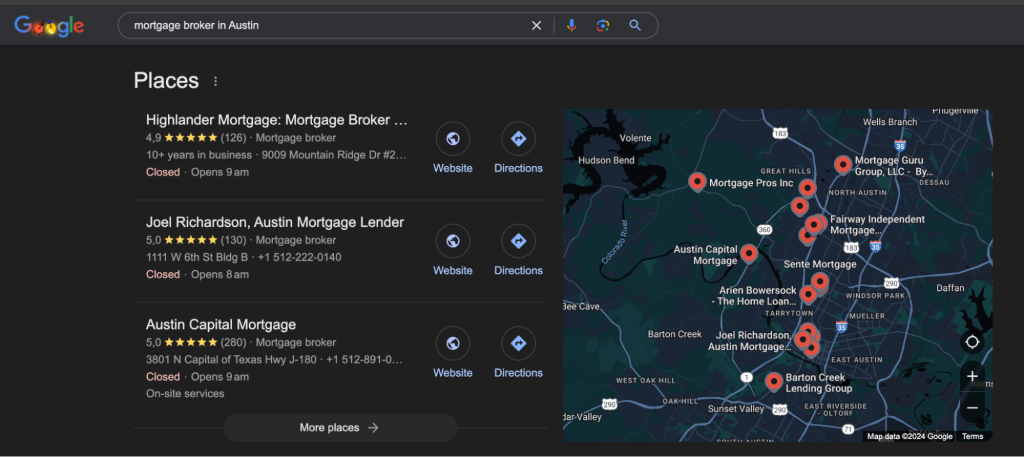

What is a Local Pack?

The Local Pack highlights top local services, showing businesses, reviews, and locations on a map—for example, a search for “mortgage broker in Austin” displays nearby brokers and their ratings.

Source: Google

Securing a spot in this section isn’t about luck—it’s about strategic optimization of your Google Business listing and ensuring consistent information across local directories.

How to set up Google Business for your mortgage brokerage

Follow these steps to create or enhance your Google Business profile:

1️⃣ Create or sign in to your Google Account

Use a Google account associated with your business to get started.

2️⃣ Go to Google Business

Navigate to Google Business to begin.

3️⃣ Add or claim your business

- If your brokerage is already listed, claim it and verify ownership.

- Click “Add your business” to start the setup process if it’s not listed.

4️⃣ Provide accurate and complete information

Include the following details:

- Business name

- Address

- Phone number

- Website URL

- Business category (e.g., “Mortgage Broker” or “Loan Officer”)

- Service areas (the cities or neighborhoods you serve)

- Business hours

5️⃣ Verify your business

Google typically sends a postcard with a verification code to your business address. Enter the code in your Google Business dashboard to confirm ownership.

| 💡Pro tip: Google sometimes offers other verification methods, such as email or phone. Check your dashboard for available options. |

6️⃣ Optimize Your Listing

A verified listing is just the start. Optimize it by adding:

- A compelling business description that highlights your expertise, specialties, and why clients should choose you.

- High-quality photos of your office, team, and any awards or certifications.

- Posts about market trends, mortgage tips, or home loan options to engage with your audience.

- Client reviews to showcase your credibility and build trust.

By prioritizing local citations and optimizing your Google Business profile, you can establish a strong local presence and attract more clients searching for mortgage brokers in your area.

Create quality content

Creating quality content is about providing value to your audience and positioning yourself as an expert in the mortgage industry. It’s not just about pleasing Google—it’s about building trust with your potential clients.

But what does “high-quality” content look like for mortgage brokers? Let’s break it down:

✔️ Relevant

Your content should address your audience’s specific needs and questions. Consider topics like “How to Get Pre-Approved for a Mortgage,” “Understanding VA Loans,” or “Tips for First-Time Homebuyers.” This will help potential clients see you as a trusted resource.

✔️ Professional

Content riddled with typos and grammar errors can undermine your credibility. Polished, well-written articles show clients you’re knowledgeable and reliable—someone they can trust with one of the biggest financial decisions of their lives.

✔️ Original

Don’t just rehash the same advice found all over the internet. Offer unique insights into your local market or specialize in niche topics like FHA loans or investment properties. Original content sets you apart and keeps your audience engaged.

✔️ Trustworthy

Back your claims with data and cite reputable sources. Include testimonials from satisfied clients or case studies about how you helped secure tricky mortgages. Trust is critical in the financial space; demonstrating transparency can set you apart.

✔️ Keyword-Rich

Think of keywords as the breadcrumbs that lead search engines to your content. Strategically incorporate relevant keywords into your articles, but avoid overloading your text. For instance, if writing about “mortgage brokers in Denver,” use variations like “Denver mortgage lenders” or “home loan experts in Denver.”

| 💡 What is keyword stuffing?

Keyword stuffing happens when keywords are overused unnaturally, making the content awkward to read. It can harm your rankings and frustrate readers. Stick to using keywords naturally. |

✔️ In-depth

Your audience likely has big questions about the mortgage process. Go beyond surface-level explanations and dive deep into topics to provide actionable advice and insights that build confidence in your expertise.

✔️ Multimedia-rich

Include images, charts, videos, or infographics to make your content visually appealing and engaging. For example, a visual guide showing the steps to securing a mortgage can make complex information easier to digest.

✔️ Shareable

Content that resonates with your audience is more likely to be shared. The more people share your content, the broader your reach is, and the more likely that Google will rank your website higher.

| 💡 Key point: Show E-E-A-T

In other words… your content needs to showcase E-E-A-T: ➡️Experience: Demonstrate hands-on expertise and knowledge in mortgage brokering. ➡️Expertise: Share accurate and helpful information backed by data or case studies. ➡️Authority: Position yourself as a credible source in your niche with unique insights and client testimonials. ➡️Trustworthiness: Build trust through transparency, professional writing, and verified claims. |

How to create content as a mortgage broker

1️⃣ Brainstorm content ideas

Before writing, generate some ideas for content that will resonate with your audience. Here are a few ways to do this:

- Client questions: What do clients frequently ask you? Use these conversations to guide your content.

- Competitors: Check out what competitors write about and find ways to improve or add a unique perspective.

- Keyword research tools: Use tools like Ahrefs or Google Keyword Planner to uncover what people are searching for online.

2️⃣ Perform keyword research

Keywords are the words or phrases people type into search engines to find information. For mortgage brokers, identifying keywords is crucial to attracting potential clients online.

To find these SEO keywords, you’ll need keyword research tools. While there are many options, we’ll use Ahrefs in this example.

Find your seed keywords

Start with broad topics related to your mortgage services. Consider what you offer and what questions your clients typically ask, such as:

🔎Mortgage rates

🔎First-time home buyer

🔎Refinance

🔎Home equity loan

These will be your seed keywords.

| 💡Pro tip: Even without paid tools, Google’s Keyword Planner is free and highly effective for finding relevant terms. |

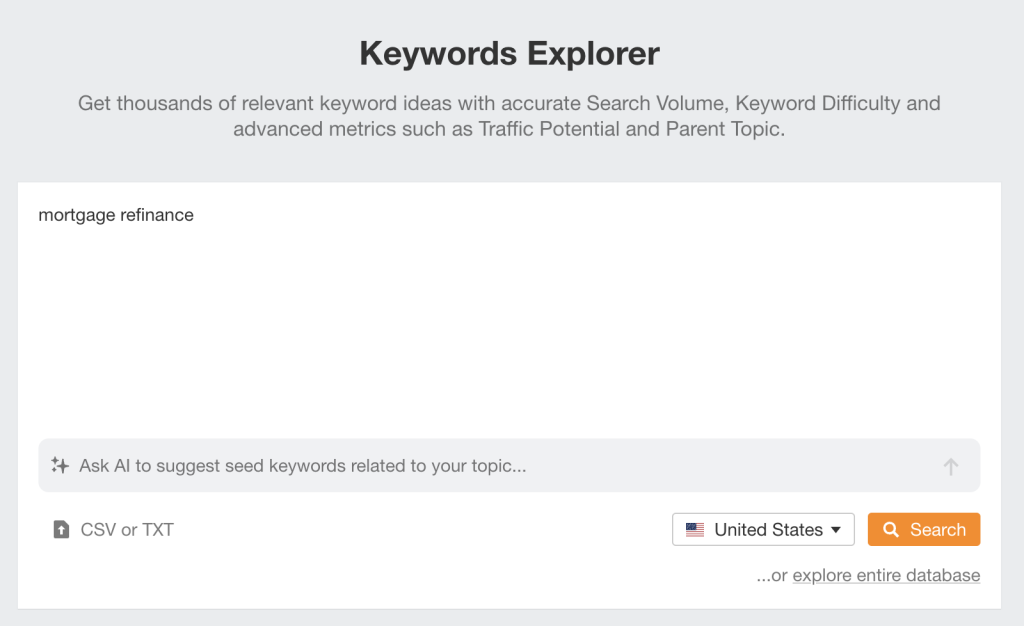

Go to Keywords Explorer

In Ahrefs, navigate to the Keyword Explorer tool and input your seed keywords. For example, “mortgage broker near me” or “best mortgage rates.”

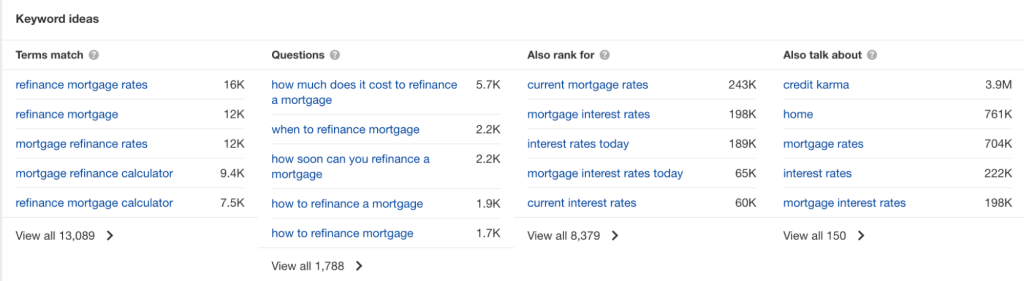

Let’s use “mortgage refinance” as an example:

Source: Ahrefs

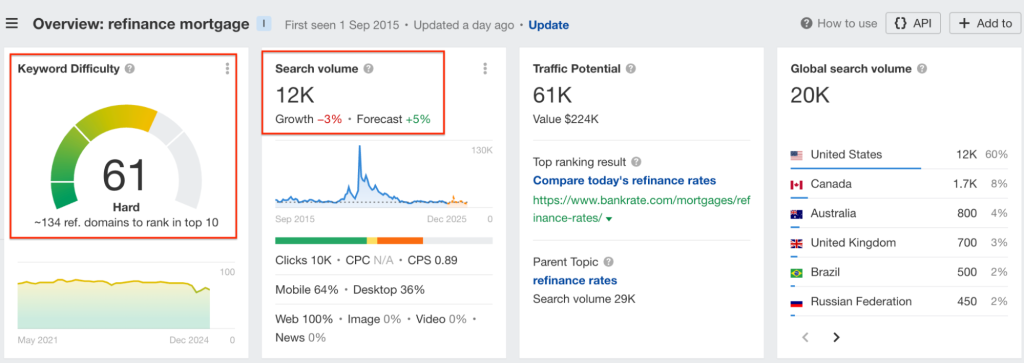

Analyze keyword metrics

Ahrefs will generate keyword ideas with helpful metrics:

📊Search volume: How many people search for this keyword?

📊Keyword difficulty: How hard it is to rank for this keyword.

📊Traffic potential: How much traffic you could get if you ranked #1.

The screenshot below shows that “mortgage refinance” has a keyword difficulty of 61, which means it’s hard to rank organically. It has a search volume of 12,000 and a traffic potential of 61,000 searches per month:

Source: Ahrefs

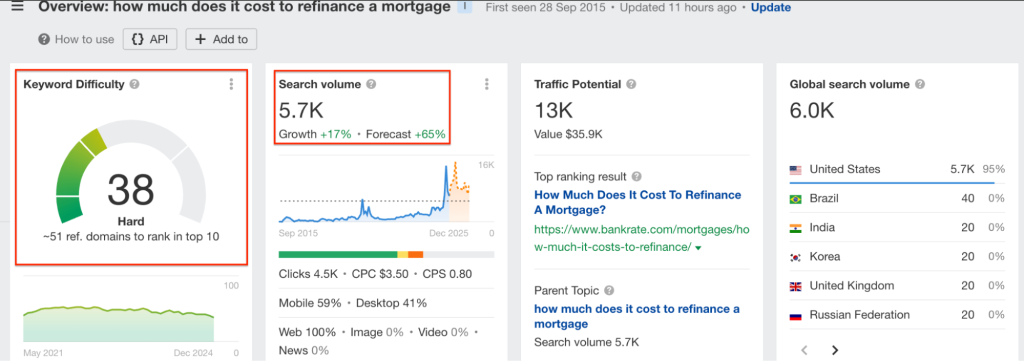

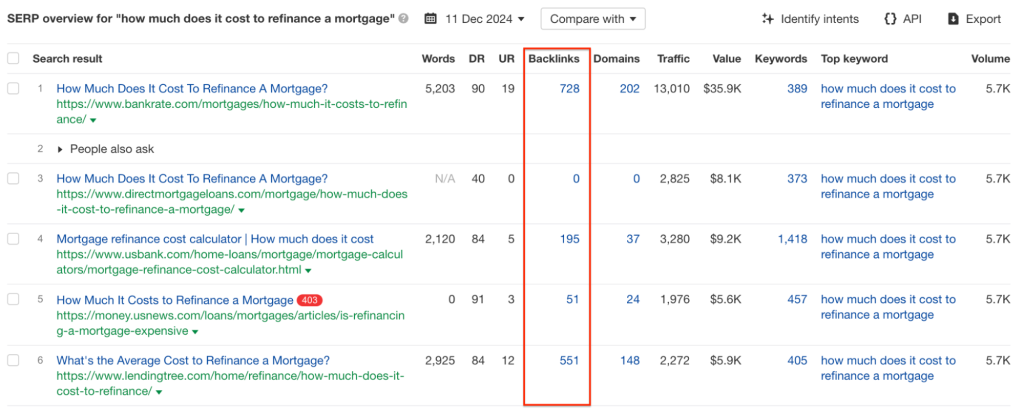

Check keyword ideas

Ahrefs also suggests related keywords, long-tail keywords, and questions potential clients might be searching for. These could include:

- Refinance mortgage calculator (search volume: 9.4K)

- Best mortgage refinance rates (search volume: 12K)

- how much does it cost to refinance a mortgage (search volume: 5.7K)

Source: Ahrefs

Focus on long-tail keywords, as they are usually less competitive and reflect a more specific search intent. For example, targeting a broad keyword like “mortgage refinance” is highly competitive and difficult to reach the top of search engine rankings.

However, in the keyword ideas section, you might find a more manageable alternative, such as “How much does it cost to refinance a mortgage.” This long-tail keyword has 5,700 searches per month and a keyword difficulty of 38, making it a better option for driving targeted traffic with less competition.

Source: Ahrefs

| 💡Key point: What is search intent?

Search intent, also known as user intent, refers to the purpose behind a user’s search query. It’s what the user is looking to accomplish when they type something into a search engine. Common examples of general search intent include:

|

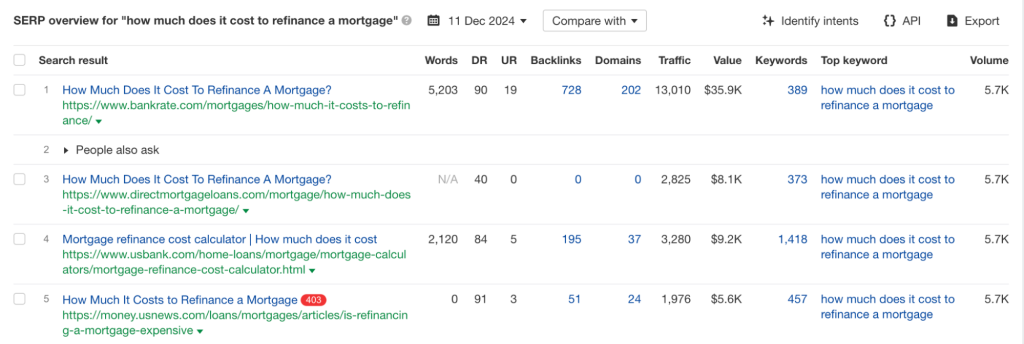

Check the SERP overview

Use Ahrefs’ SERP overview to analyze the competition for your chosen keywords. Look at:

👀Who’s ranking: Are they local brokers, banks, or comparison websites?

👀Content quality: What kind of content are they using? (e.g., service pages, blog posts, calculators).

Source: Ahrefs

Export your keywords

Export your keyword list from Ahrefs for easy reference:

- Go to “Keyword Ideas“

- Click “View All” to see the complete list.

- Click “Export” and download the data as a CSV file.

3️⃣ Organize a content calendar

Map out a plan for your content strategy. Decide on topics and publish dates to keep your content pipeline flowing consistently.

4️⃣ Create engaging content

The fun part is writing content that answers client questions and provides value. If writing isn’t your strong suit, consider hiring a professional writer to ensure your articles are polished and professional.

Producing high-quality, relevant content can attract potential clients and build trust and credibility. Over time, this strategy can position you as the go-to expert in your market.

Optimize Technical SEO

Technical SEO ensures that search engines like Google can crawl, index, and understand your website. The behind-the-scenes work helps your site perform well in search rankings while offering visitors a smooth experience.

Optimizing technical SEO is critical for mortgage brokers to ensure potential clients find your services online. Here are the key areas to focus on:

✔️ Page Speed

A fast-loading website is essential for both user experience and search rankings. Potential clients won’t wait for slow pages, and Google may penalize your site for poor performance.

ℹ️Test your site’s speed with Google PageSpeed Insights. Aim for page load times of under 3 seconds to keep visitors engaged.

| 💡 Pro tip: Compress images and reduce unnecessary code to speed up your site. |

✔️ Mobile-Friendliness

Most people search for mortgage brokers on their smartphones, so a mobile-friendly site is non-negotiable. Additionally, Google’s algorithms prioritize the mobile version of your site when ranking search results.

- Use a responsive design to ensure your website adjusts seamlessly to all screen sizes.

- Test your site’s mobile-friendliness with Google Lighthouse.

✔️ Website structure and navigation

A well-organized website improves user experience and makes it easier for search engines to crawl your pages.

- Clear site architecture: Use categories and subcategories for services like “Refinancing,” “First-Time Buyer Mortgages,” or “VA Loans.”

- Internal Linking: Connect related pages on your site to guide users and distribute ranking power. For example, link a blog post about “Mortgage Pre-Approval” to your “Apply for Pre-Approval” page.

- XML Sitemap: Submit an XML sitemap to search engines to help them discover and index your content.

| 💡 Pro tip: Here’s a guide on how to create and submit an XML sitemap. |

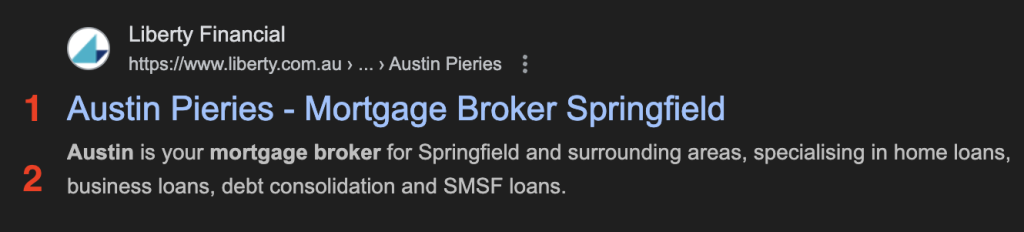

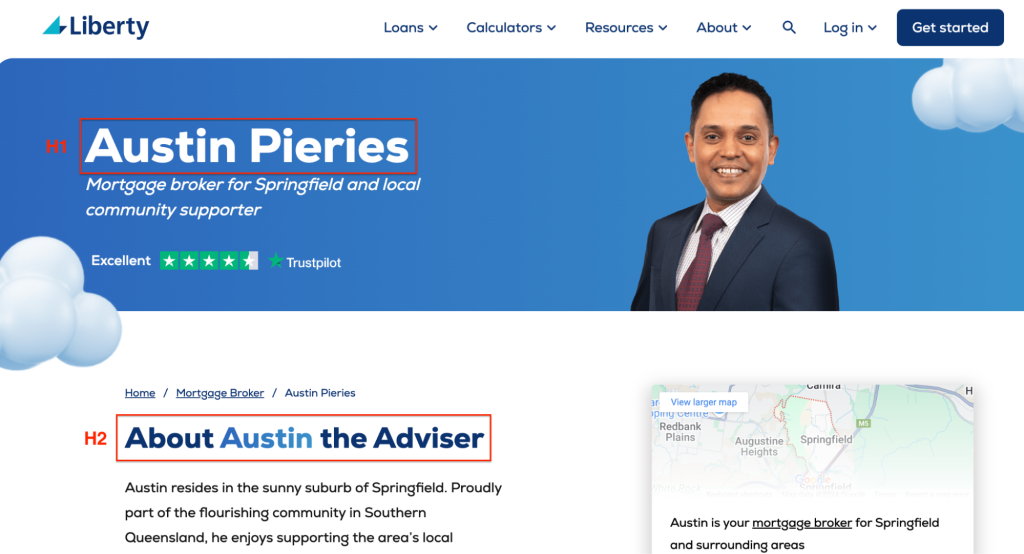

✔️ Meta tags and header tags

Meta tags and header tags help search engines understand your content and improve user experience:

➡️Title tags: Title tags are the clickable headlines in search results. Create clear, keyword-rich titles that reflect the page content. Keep them concise (50-60 characters) and engaging to encourage clicks and stand out from competitors.

➡️Meta tags: Meta descriptions are summaries that appear below the title tag. Craft informative, keyword-friendly descriptions that summarize the page’s content in 150-160 characters and entice users to click.

Here is an example of a search result for “mortgage broker in Austin.” In the screenshot, 1 is the meta title, and 2 is the meta description.

➡️Header tags: Structure your content with H1, H2, and H3 tags to create a clear hierarchy and improve readability:

Source: Austin Pieries

✔️ URL structure

Create clean, descriptive URLs that include relevant keywords. For example:

✅ www.yoursite.com/first-time-buyer-mortgage

❌ www.yoursite.com/page123?id=456

Advanced technical SEO

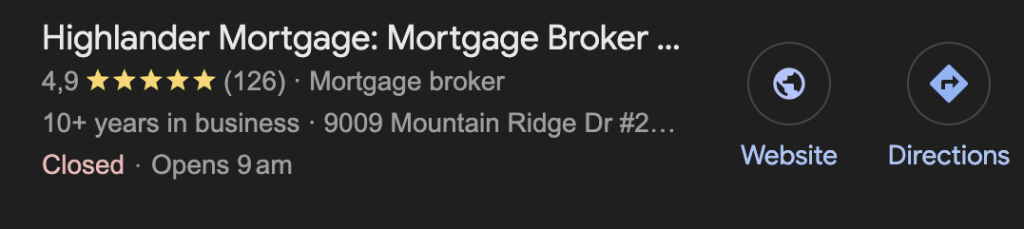

Schema Markup

Schema markup adds context to your pages, helping search engines provide enhanced results like star ratings or FAQs. For mortgage brokers, schema can highlight reviews, services, and contact information:

Source: Google

| 💡Pro tip: Learn how to implement schema markup. |

Robots.txt

Think of Robots.txt as a set of instructions you give to search engine bots. It directs search engines to important pages and excludes irrelevant ones, like admin areas.

Canonical Tags

Canonical tags prevent duplicate content issues by specifying the preferred version of a page.

HTTPS Security

Secure your site with an SSL certificate. HTTPS ensures a safe browsing experience for your clients and improves your rankings.

| 💡 Pro tip: Here is a guide on implementing HTTPS encryption on your website. |

404 error handling

Create a custom 404 page with helpful links to keep visitors engaged. For example, redirect them to popular pages like “Mortgage Services” or “Contact Us.”

Optimize off-page SEO

Off-page SEO focuses on building your reputation outside your website and establishing yourself as a trusted expert in the mortgage industry. It’s a powerful way for mortgage brokers to stand out in a competitive market and boost their visibility.

The backbone of off-page SEO is link building—earning backlinks from other reputable websites to your own. These backlinks act as votes of confidence, signaling to search engines that your site is authoritative and trustworthy. The more high-quality backlinks you have, the higher your chances of ranking well in search results.

| 💡Key point: Quality vs. quantity?

When it comes to backlinks, quality trumps quantity. Instead of aiming for as many links as possible, focus on securing links from authoritative, relevant financial or real estate sites. ✅A quality backlink example: Being featured in a trusted publication like Forbes or a local news outlet for insights on mortgage trends. These links boost your credibility and enhance your SEO. ❌A poor backlink example: Links from irrelevant, low-quality directories or spammy blogs unrelated to mortgages. These can harm your rankings and should be avoided. |

Let’s illustrate this with an example: Consider the local search term “mortgage broker near me.” While less competitive than broader terms, securing a top spot still requires a robust backlink profile. The top-ranking websites for this keyword have a significant number of backlinks:

Source: Ahrefs

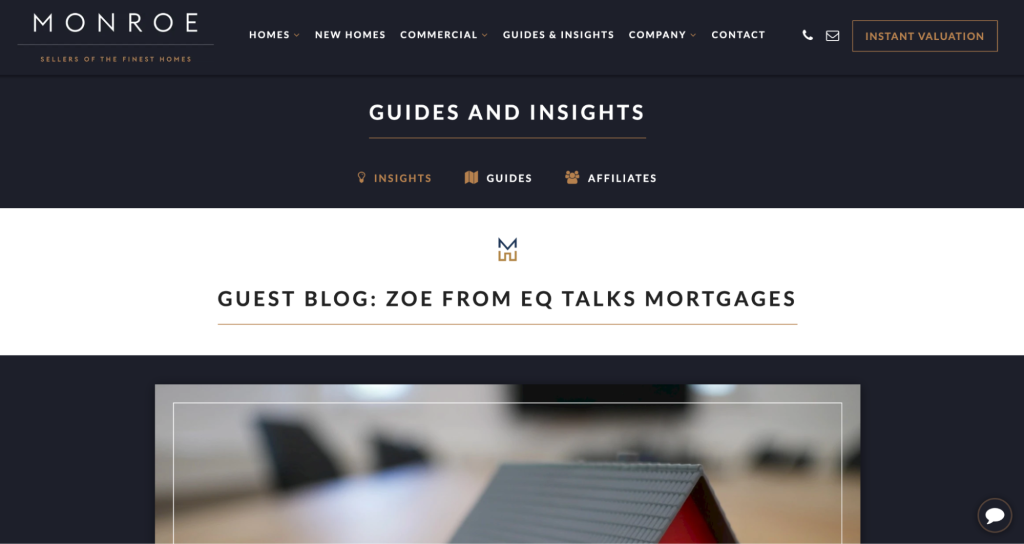

Contribute guest posts

Guest posting is a powerful off-page SEO strategy that involves contributing articles to other websites or blogs in your industry. By sharing your expertise, you can gain exposure to a new audience while earning valuable backlinks to your site, which helps improve your SEO rankings.

You can also pursue link insertion outreach – having your link placed into pre-existing relevant blog posts on other websites – to gain additional contextual backlinks.

Here’s how to get started with guest posting:

1️⃣ Identify reputable websites

Look for websites in the finance, real estate, or personal finance niches that align with your services. Examples might include:

- Local real estate blogs.

- Financial planning websites.

- Homebuying advice platforms.

2️⃣ Pitch relevant content ideas

Reach out to these websites with ideas for articles that will resonate with their audience. For mortgage brokers, topics like:

- “5 Common Mortgage Myths Debunked”

- “How to Choose the Right Mortgage for Your Needs”

- “Understanding the Mortgage Process for First-Time Buyers”

3️⃣ Provide valuable, high-quality content

Write detailed, engaging, and informative content demonstrating your mortgage industry expertise. This will not only help the host site but also build trust with readers, increasing the likelihood they’ll click on your backlink.

4️⃣ Request a backlink

Ensure your website is linked to the content or your author bio. For example, you could include a link to your “Mortgage Calculator” page in an article about budgeting for a home (more on this below!).

ℹ️ Example: A mortgage broker contributed an article about how to navigate getting a mortgage in 2024’s economic climate for a real-estate blog:

Source: Monroe Real Estate Agents

| 💡 Pro tip: Focus on websites with strong domain authority and relevant audiences. Avoid low-quality or irrelevant sites; these links won’t provide much SEO value. |

Linkable assets

If you want to attract backlinks, focus on creating valuable resources that other websites can’t resist linking to. Linkable assets are tools, guides, or resources that solve your audience’s problems and offer genuine utility.

Go the extra mile by developing content that stands out and directly addresses your audience’s needs. For mortgage brokers, some great linkable asset ideas include:

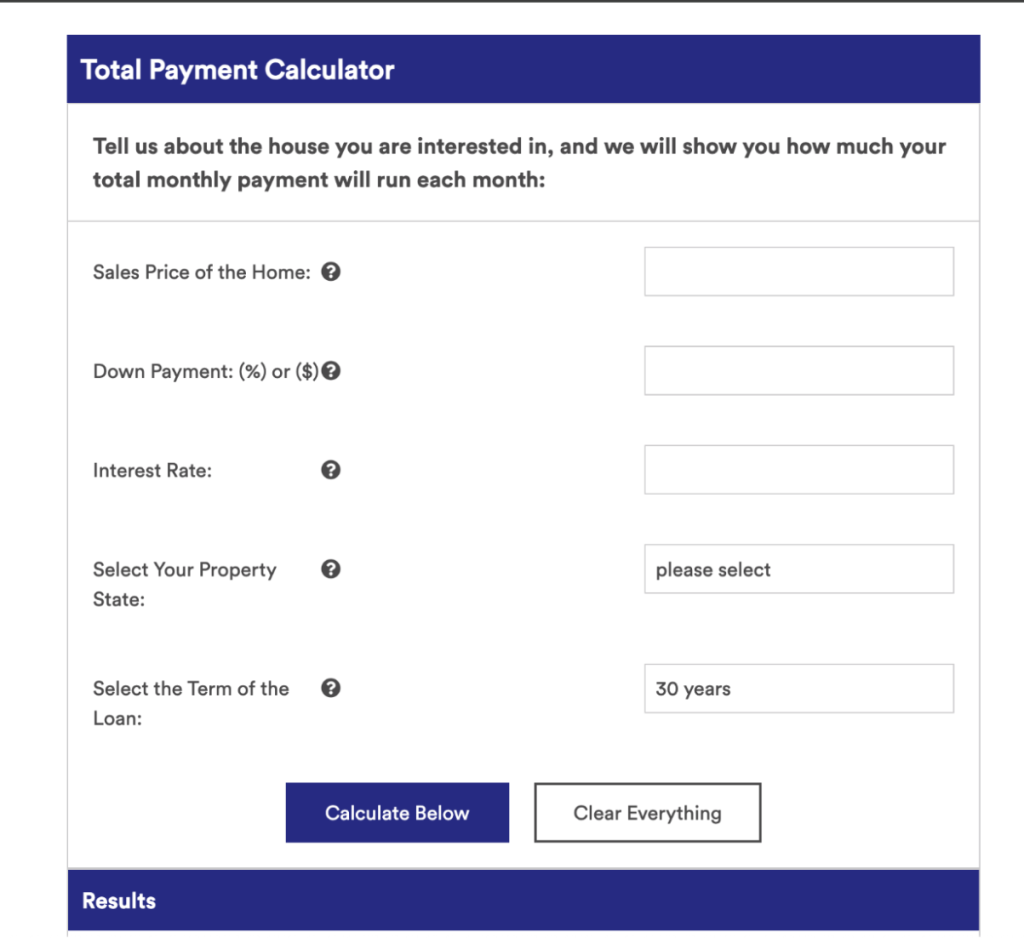

➡️Interactive mortgage calculators: Help potential clients estimate their payments, compare loan types, or evaluate refinancing options. Here’s one from Guild Mortgage:

Source: Guild Mortgage

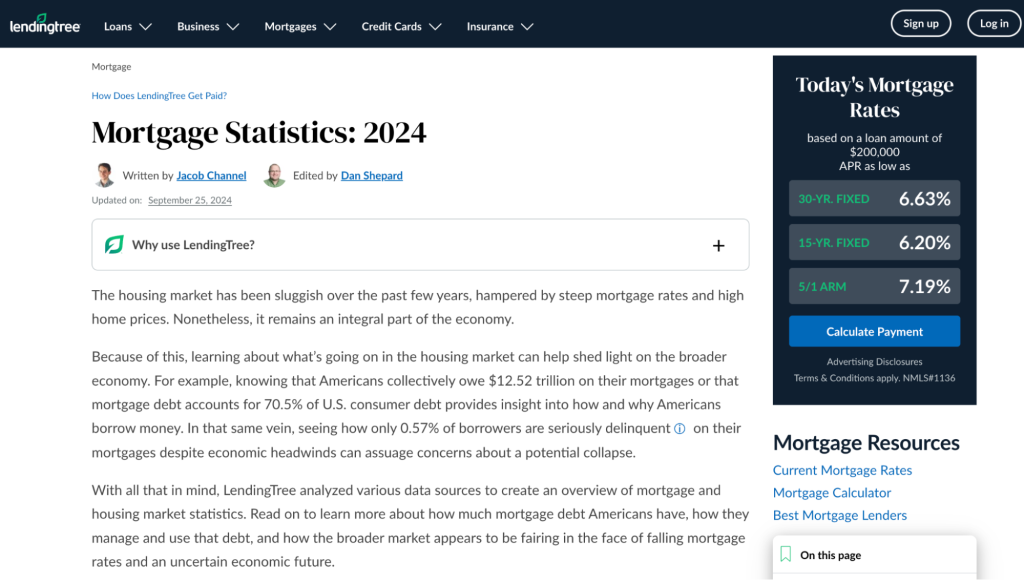

➡️Local market reports: Provide up-to-date insights into your area’s housing market, like average home prices, mortgage rates, or buyer trends. Here’s a report on mortgage statistics for 2024 from Lending Tree:

Source: Lending Tree

➡️Comprehensive guides: Create step-by-step resources like this guide on how to buy a house as a single person:

Source: Guild Mortgage

| 💡 Pro tip: Once your asset is live, spread the word! Share it on your social media platforms, include it in your email newsletter, and collaborate with local real estate agents or financial advisors to expand its reach. |

PR backlinks

Earning PR backlinks is a powerful way to increase the visibility of your mortgage brokerage website. These backlinks come from news outlets and media sites, boosting your credibility and signaling to search engines that your business is reputable.

We recommend that you partner with a digital PR agency to help you craft and distribute compelling press releases to a wide network of journalists and media outlets. This will increase your chances of being picked up by major publications and earning those coveted backlinks.

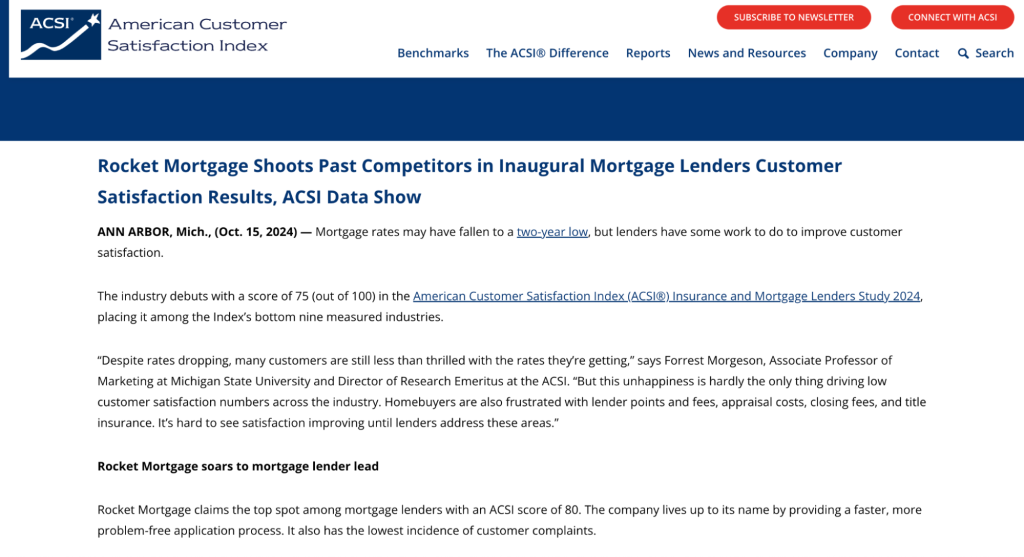

ℹ️ Example: When the American Customer Satisfaction Index (ACSI®) Insurance and Mortgage Lenders Study 2024 was released, it attracted media attention, earning it backlinks from a number of high-authority sites, including PropertyCasualty360, MarketWatch and National Mortgage Professional, to name a few:

Source: American Customer Satisfaction Index

Infographic link building

They say a picture is worth a thousand words, and this couldn’t be more true for SEO. Infographics—visual representations of data and ideas—are potent tools for mortgage brokers to simplify complex concepts, making them easy to digest and share. They naturally attract backlinks because other websites love featuring informative and visually appealing content.

1️⃣ Identify key questions or data points

Think about the questions your clients frequently ask or data that could surprise or educate them. For mortgage brokers, great infographic topics could include:

- Mortgage rate trends over time.

- A side-by-side comparison of fixed vs. adjustable-rate mortgages.

- The step-by-step mortgage approval process.

2️⃣ Invest in professional design

Ensure your infographic is visually stunning and professional. Use vibrant colors, clean fonts, and engaging illustrations to grab attention while staying true to your brand.

3️⃣ Make it shareable

Once your infographic is ready, share it widely:

- Publish it on your website and optimize it with relevant keywords.

- Share it on social media platforms and tag local businesses or influencers.

- Reach out to industry blogs or news outlets that might find the content valuable.

ℹ️ Example: This infographic by Jefferson Bank has created this infographic to explain the difference between fixed vs adjustable mortgages:

Source: Jefferson Bank

Final Thoughts: Search Engine Optimization For Mortgage Brokers

This guide has given you a powerful SEO strategy to attract more clients to your mortgage business. Remember that SEO is an ongoing process, but the rewards are worth it: increased visibility, qualified leads, and a stronger online presence.

Ready to take your mortgage broker SEO to the next level?

Partner with Authority Builders! Our SEO experts will help you with the following:

👑Achieve top rankings: Dominate search results for valuable mortgage keywords.

👑Attract more clients: Drive qualified leads to your website and convert them into customers.

👑Build authority: Establish your brand as a trusted mortgage expert in your local market.

Contact us today for a free consultation and discover how we can help you grow your mortgage business!