The world’s financial industries were estimated to have grown 7.7% between 2023 and 2024.

With a total value of around $33.54 trillion, it’s thought that the sector now accounts for a massive 31% of the world’s economy.

Digitalization means global financial markets can be accessed easier and faster than ever, while AI and automation are driving productivity in the sector.

But this growth means the sector is hugely competitive. To be successful, businesses need to use every marketing tool available to them.

Search Engine Optimization (SEO) is one of these. It involves ensuring your website appears at the top of results when people search for finance-related products, services, and information. It’s an effective way to attract new leads and convert them into paying customers.

And with 41% of all traffic to finance industry websites coming from organic search, it’s no wonder that SEO is critical to the industry.

However, SEO for financial services has some unique requirements that you need to know to be successful.

In this article, we explain what those requirements are and how you can use SEO to capitalize on the finance sector’s meteoric growth.

What is SEO for Financial Service Companies?

SEO is the processes and techniques involved in optimizing your website to rank higher on search engines for specific keywords.

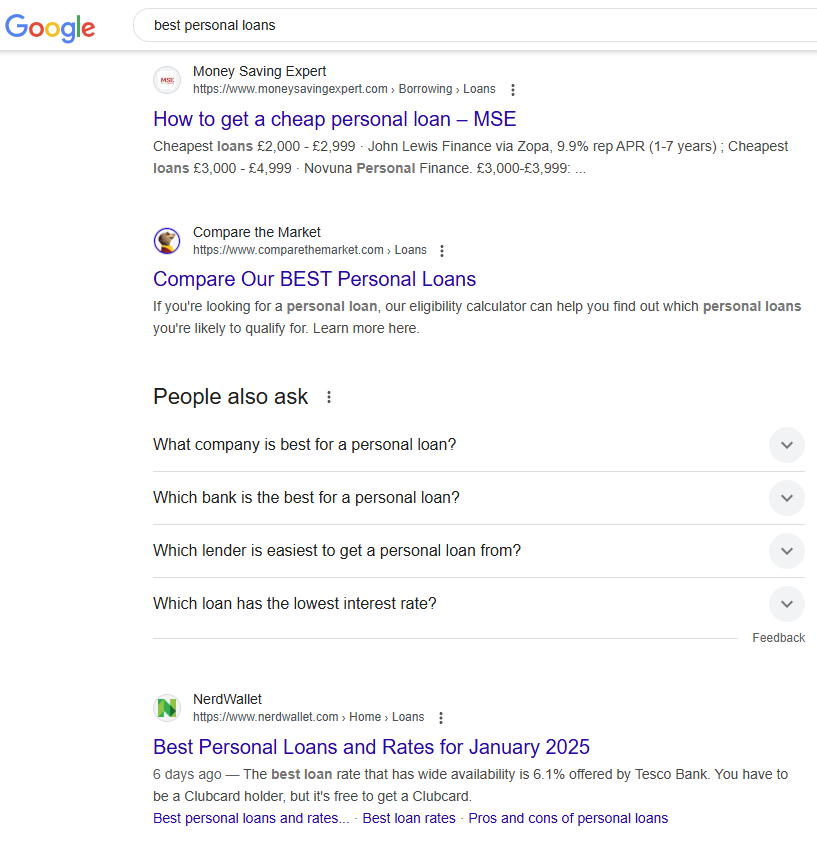

Keywords are the queries people type into search engines. For example, let’s say you wanted to generate more traffic for your personal loans page. You might try to rank for the keyword “best personal loans”.

When a user types this into a search engine like Google, the platform instantaneously analyzes millions of pages to decide which it thinks best matches the user’s request.

Here’s what it might look like:

The search engine considers a whole range of factors when deciding what to show, but the most important ones are:

- The page’s relevance to the query: For example, you wouldn’t expect to get information about business loans when searching for personal loans. Google does this by assessing the different keywords used on each page.

- The page’s and domain’s authority: This is how respected the page or website is in its niche. For example, if lots of people share a page listing the best personal loans because they think it’s useful, then Google will rank it higher.

- The quality of the content: Google is more likely to rank well-researched content that covers a top in-depth using a variety of different media over thin, poor-quality content.

- The website’s user experience: Google prioritizes fast, easy-to-navigate websites that are optimized for different screen sizes and devices.

Some terms are harder to rank for than others. That’s usually because they generate more traffic or are more likely to result in the user making a purchase.

Competitive terms like these are often harder to rank for, so you’ll have to put a lot of effort into your SEO to win them.

| 💡 Understanding search intent

Search intent is what the user wants to get out of their search. For example:

It is critical to understand search intent when launching a financial services SEO campaign. |

Now you have a good idea of what SEO for financial services is, let’s take a look at why it works so well for them.

Why do Financial Services Companies Need SEO?

Financial services companies can reap many benefits from SEO campaigns. The main ones include:

More website traffic

SEO helps financial institutions rank higher on search engine results pages (SERPs), ensuring they attract more visitors to their websites. They can target prospective clients actively searching for financial solutions, driving organic traffic to their services.

More leads

SEO doesn’t just bring more visitors—it brings the right visitors. It enables financial services companies to connect with individuals and businesses actively looking for loans, insurance, investment advice, or other services. These high-intent visitors are more likely to convert into valuable leads than those simply seeking information.

Brand awareness

Appearing prominently in search results reinforces trust and credibility among potential clients. Even if users don’t immediately engage, repeated exposure to a financial services company’s name builds recognition over time. SEO ensures consistent visibility, positioning your brand as a leader in the financial sector and keeping you top-of-mind for future needs.

Powerful returns

SEO can generate a serious return on investment (ROI). To prove this, let’s take a look at an example. Say you’ve launched an SEO campaign to rank number one for the term “best savings account”.

This has a search volume of 50,000 monthly visitors in the United States.

Now let’s say you manage to rank number one for this term. Getting there might take some time and effort, but once you do, you can expect to get around 39.8% of the search volume.

Financial services tend to have a lead conversion rate of 3–7%. Let’s assume you achieve the low end of that, which is around 1,500 conversions per month.

The average U.S. personal loan amount is $11,652, while the average interest on those loans is 21.44% or around $2,498.

Based on this, here’s the calculation for your projected monthly revenue:

1,500 x $2,498 = $32,853,696

That’s pretty impressive! Especially given that SEO services cost $2,917 per month on average.

Of course, achieving this isn’t easy. In the next section, we’ll explain some of the challenges involved in financial services SEO.

What Unique Challenges Does Financial Services SEO Face?

Here are some of the issues financial services companies need to be aware of before launching SEO campaigns.

It is a Your Money or Your Life (YMYL) industry

Google tries to ensure that the information it provides users with is as reliable as possible. This is especially true for subjects and industries where people will use the information it provides to make decisions regarding their:

💊 Health

🚧 Safety

🤝 Welfare

💰 Financial stability

Google refers to these topics as “Your Money or Your Life” (YMYL) and has stricter experience, expertise, authoritativeness, and trustworthiness (EEAT) requirements for sites that cover them.

That’s because if they provide poor quality information on one of these topics then it could seriously impact the user’s life.

What is EEAT?

EEAT is a series of factors that Google uses to determine good quality content. Here’s a summary of each:

- Experience: You need to show that you have first-hand experience in dealing with the subject, not simply theoretical knowledge. For example, you are more likely to rank for “best personal loans” if you actually sell loans. You could prove this by publishing case studies based on happy clients.

- Expertise: This is about proving your sector knowledge and skills. It can be achieved by posting guides on your blog or by showcasing your professional memberships and accreditations.

- Authoritativeness: This is how respected you are in your industry. For example, if your website is often mentioned and linked to online as a reliable source of personal loans, then Google is more likely to rank you higher for this term.

- Trustworthiness: This is about proving you’re a real company that engages in legitimate business. You can prove this by publishing your office address online, generating positive user reviews and even linking to your staff’s professional profiles online.

By only presenting websites that meet these requirements, Google ensures that it provides reliable information and helps keep its users safe.

Competition

Financial services are hugely profitable and in demand. Plus, recent technological developments mean new businesses, products and services are being launched more often than ever. This means that the sector is hugely competitive—ranking for popular terms could take several years of consistent hard work.

Complexity

Financial services often involve complex concepts or processes. This makes it difficult and time-consuming to write about them in a way that audiences will understand and find useful.

Quality requirements

Quality content isn’t just about ranking in search. Visitors won’t trust your brand unless the content it provides is professional and accurate.

Financial Services SEO Checklist: 8 Steps to Boost Your Rankings

We could write an entire book on SEO for financial services. Instead, this section provides a checklist of things you need to consider, along with links to useful resources where you can find out more.

1. Perform an SEO audit

An SEO audit is where you take a look at all aspects of your SEO to decide which areas are lacking and what steps you need to take to improve them.

It’s the first step in any SEO strategy. Conducting an SEO audit involves the following steps:

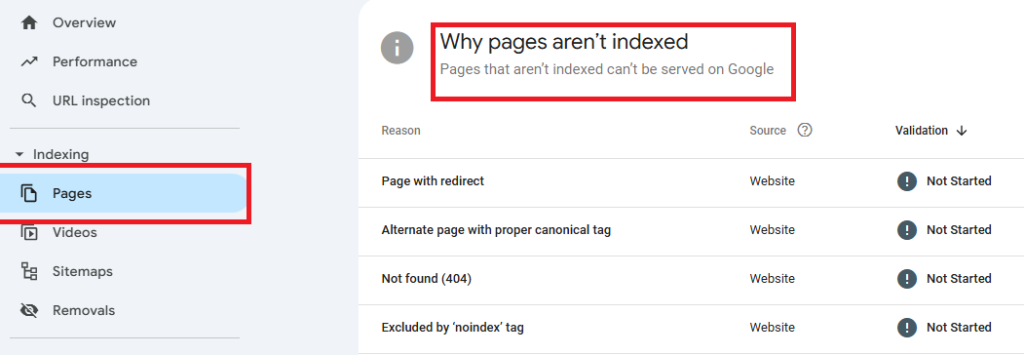

Analyze technical SEO: Use tools like Google Search Console to check for crawl errors, broken hyperlinks, and slow loading speeds.

Do this by opening Search Console and clicking on the “Pages” tab. Scroll down to where it says “Why pages aren’t indexed.” This will give you information on the technical errors your site is experiencing.

Evaluate on-page SEO: On-page SEO involves the parts of the website the user sees and interacts with. Review your site’s keyword usage, meta tags, header structures, and overall content relevance. Ensure these elements align with your target audience’s search intent.

We’ll explain more about these concepts, later in the article.

Assess content quality: Analyze your existing content to identify opportunities for optimization, expansion, or the creation of new pieces. Focus on providing value and addressing user queries effectively.

Review backlink profile: Backlinks are when other websites publish hyperlinks to your content. Having lots of backlinks from a broad range of relevant, respected websites will help improve your website’s authority.

Examine backlinks pointing to your website to identify those from spammy, poor quality websites. If you have too many then you can disavow harmful links.

Check out this article for more information on what a harmful link is and how to remove them.

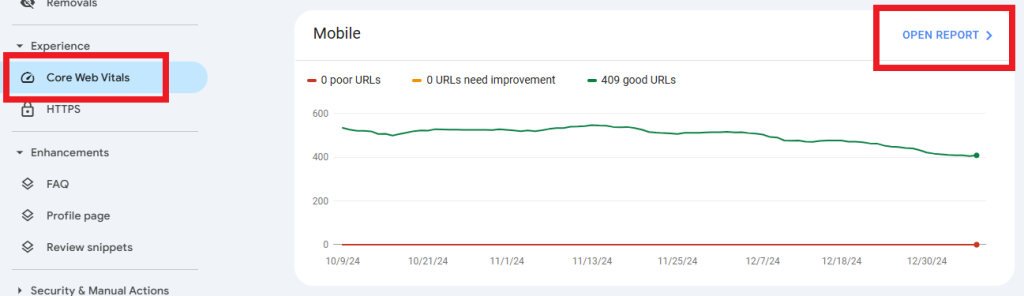

Check mobile-friendliness: Ensure your website is responsive and performs well on mobile devices. Google prioritizes websites that are optimized for mobile devices. This means a poor mobile experience can hurt your rankings.

You can check how mobile-friendly your website is and spot related issues using Google Search Console.

Select the “Core Web Vitals” tab in the left menu and scroll to “Mobile”. This will show how many pages are optimized for mobile. Click on “OPEN REPORT” to see detailed information about any issues that need fixing.

Optimize core web vitals: How fast your web pages load impacts the user experience and your rankings on Google. You can use Google Page Speed Insights to check for issues.

Type your domain into the search bar and you’ll be shown a series of factors relating to loading times and given a rating for each. The tool uses a traffic light system and rates every page on your website and based on this gives an overall rating of pass, fail or needs improvement.

You can then scroll down to find the issues your site has and how to fix them.

Benchmark against competitors: Compare your site’s performance, content and backlinks to competitors in the financial sector.

One of the best ways to do this is to use an SEO tool like Ahrefs. In Ahrefs, choose “Competitive Analysis” in the top menu. Type your domain in the top bar and then your competitors’ in the lower ones. Choose to compare keywords, referring domains or backlinks.

Ahrefs will then show you a list of content that your competitors rank for but you don’t or pages or domains that link to your competitors but not you.

The idea is that if these keywords and backlink opportunities work for your competitors then they may work for you as well. You can base content or link building campaigns around them—more on how to carry out a campaign later.

2. Perform keyword research

Keyword research is the foundation of a successful SEO strategy for financial services companies. Identifying and targeting the right keywords ensures your content attracts the right audience, improves search engine rankings, and demonstrates your expertise in the industry.

Here’s how financial services companies can perform effective keyword research:

Understand your target audience: For example, what products, services and information will be useful for them, as well as their pain points and the challenges you can help them with.

Come up with keyword ideas: Brainstorm keywords that you think your clients and customers will use. You can also use the Ahrefs competitive analysis mentioned earlier to come up with keyword ideas.

Target long tail keywords: Basic keywords like “loans” are known as seed keywords. They tend to be broad, high-traffic and competitive.

Long tail keywords are more specific keywords, like “personal loans for bad credit guaranteed approval online” get less traffic and so are often easier to rank for.

It’s often better to target lots of these keywords than to put all your effort into one or two competitive terms.

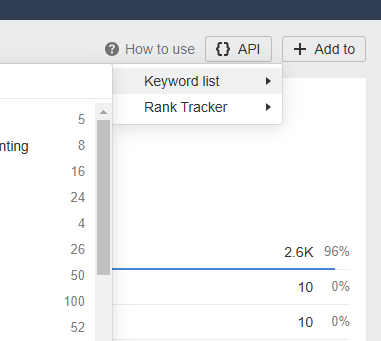

Prioritize keywords: Once you have a list of at least 100 keywords, type each one into Ahrefs’ Keywords Explorer. This will give you a ton of information on each term.

The most important information you need is:

- Keyword Difficulty: A measure of how competitive the term is.

- Search volume: The amount of organic search traffic the keyword generates each month in your territory.

Add each keyword to a spreadsheet, along with these two datapoints. You can do this manually or within Ahrefs by clicking the “Add to” button in the top right.

You can now reorder your keywords to find the best opportunities. The best keywords have high traffic and low competition.

3. Create high quality content

Now you have a list of keywords you can start producing content. Content is critical for SEO in general, but is especially important for financial services providers.

It helps to:

- Improve search rankings

- Generate organic search traffic

- Display your experience and expertise

- Attract links from other websites, helping to boost your authority

Here’s how to create great content:

Come up with content ideas

Take a look at your list of keywords and come up with article ideas for each keyword. Search intent is critical here, as you need to ensure your content matches what they are looking for.

As mentioned earlier, financial services can be complicated, so one way to generate search traffic is to create educational and informative content.

Not only will this attract potential clients, but it will also show that your business is an authority in the sector.

Examples of the kind of content you could produce include:

- How-to guides: Publish step-by-step guides on topics like budgeting, managing debt, or planning for retirement.

- Market insights: Provide expert commentary on economic trends, stock market movements, or legislative changes.

- Industry round-ups: Publish lists of products and services and explain who they might suit.

For example, personal finance website Nerdwallet has published this analysis of falling mortgage rates. This will be useful for people in the sector, as well as people considering buying a home.

Don’t just publish written content. Also consider:

- Videos: Videos are a great way to quickly and succinctly explain concepts. Platforms like YouTube are also good for generating followers.

- Infographics: Create visual content to explain complex topics, like tax brackets or investment growth.

- Live webinars: Engage with your audience, take questions and explain complex topics in-person.

Bank of America has posted this short video explaining how to avoid financial fraud and scams. This is useful for its customers and helps to protect its reputation.

Create a content calendar

Now you’ve come up with ideas for content, it’s time to plan its production. Quality of content is critical so you’ll need a content calendar that accounts for:

- Research

- Writing

- Design

- Filming

- Editing

- Fact checking

- Approvals

You’ll also need to make sure you have access to professionals ready to work on each stage of the process.

How often you publish content is up to you and often depends on how in-depth it is, the resources you have available to you and how often your competitors publish new content.

That said, it’s a good idea to choose a publishing cadence and stick to it. Being disciplined in this way will ensure your content calendar doesn’t begin to drift.

4. Show Your EEAT

As mentioned earlier, EEAT is critical for financial services SEO. Here’s a quick checklist of ways you can boost yours:

Expertise

- Showcase industry credentials: Highlight your team’s qualifications, certifications, and experience on your homepage and in staff profiles on the “about us” page. Include author bios for content contributors outlining their financial expertise.

- Publish high-quality content: Create in-depth articles on financial topics tailored to your audience’s needs. Regularly update this content to reflect trends and regulations.

- Utilize data and research: Support claims with data, graphs, and references to reputable sources. Conduct and share original research on relevant industry topics.

Experience

- Provide detailed case studies and success stories: Showcase real-world examples of how your services deliver results.

- Earn positive reviews and testimonials: Highlight customer testimonials and third-party reviews on your website. Display awards and recognitions from reputable organizations.

Authoritativeness

- Gain mentions from trusted sources: Collaborate with credible publications and websites for guest posts or features.

- Maintain an active social media presence: Share your content on platforms like LinkedIn and Twitter. Engage with your audience to position yourself as a thought leader.

Trustworthiness

- Display clear contact information: Include a physical address, phone number, and email on your website. Add a team page that introduces key members of staff.

- Ensure transparent policies: Clearly state terms of service, privacy policies, and disclaimers. Explain how you protect and manage user data.

- Demonstrate regulatory compliance: Display certifications or affiliations with regulatory bodies. Include disclaimers required for financial products or advice.

- Encourage user trust: Offer easily accessible customer support options. Provide FAQs to address common concerns.

- Optimize for local SEO: List your business in local directories and on Google My Business. Learn more about how to do this in our local citations article.

6. Build backlinks

We’ve briefly mentioned backlinks a few times in this article. The number of domains and individual backlinks pointing to your website, as well as the quality of those links, is one of the most critical ranking factors.

Good backlinks come from relevant, respected websites that publish high-quality, valuable content.

The best links happen naturally because people in your industry like your content or recommend your services.

However, there are some techniques commonly used to encourage others to link to your website.

This is called link building (it’s what Authority Builders do!) and here are some of the ways financial services businesses can generate these backlinks.

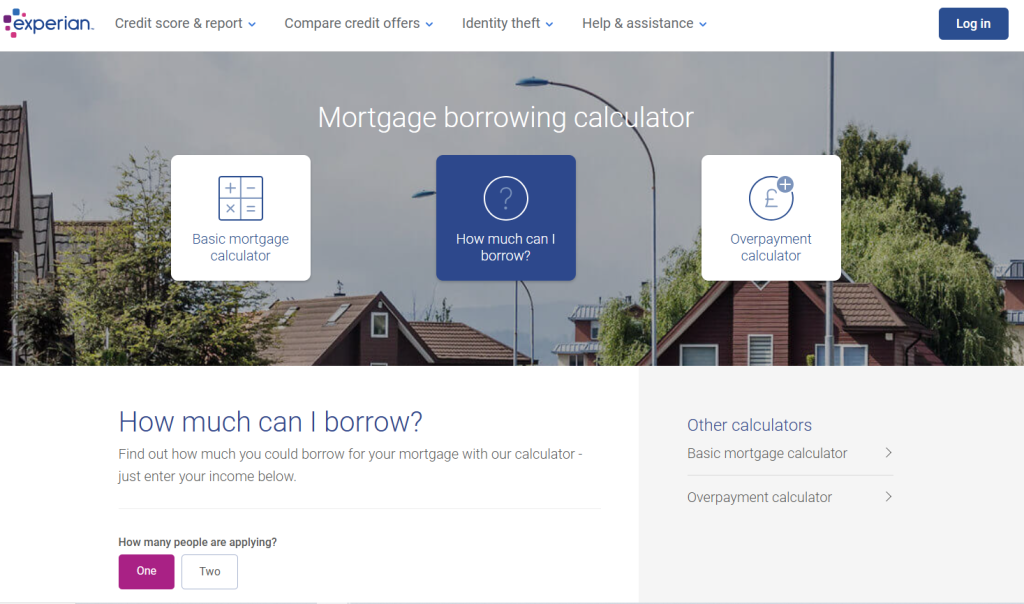

Linkable assets: This is when you create high-quality, valuable resources such as in-depth guides, calculators, or whitepapers that other websites want to link to. For financial services, creating tools like mortgage calculators or market analysis reports can attract backlinks from reputable sites, boosting your domain authority. Learn more about linkable assets.

In the example below, UK-based credit scoring company Experian has created a mortgage calculator. This has generated links from respected websites like fullfact.org and moneyplusadvice.com.

Build relationships: Networking with industry professionals, bloggers, and journalists can help you earn natural backlinks. By collaborating with others in the financial sector, you can secure links from trusted websites that share your audience.

Answer journalists’ questions: Platforms like Qwoted allow you to respond to journalists’ queries with expert insights. When your response is featured, it often includes a backlink to your site, establishing credibility and attracting relevant traffic. Learn more about getting press links.

Social Media Links: Sharing your content on social media platforms increases its visibility and the likelihood of earning backlinks. While these links are often nofollow, they can drive traffic and amplify your content’s reach, indirectly boosting your SEO efforts.

| 💡 What are nofollow links?

Nofollow is an HTML tag that tells Google not to look at where the link points. From an SEO perspective, this means you get far less of a ranking benefit from a nofollow link. The opposite to nofollow is dofollow. You should aim to build as many dofollow links as possible while link building. |

Guest posts: This is when you write articles for other websites in the financial niche. Guest posts are good because they enable you to:

- Choose high-quality, authoritative sites to build backlinks with.

- Demonstrate your expertise.

- Ensure your content provides real value to readers.

Check out our 15 best guest post opportunities.

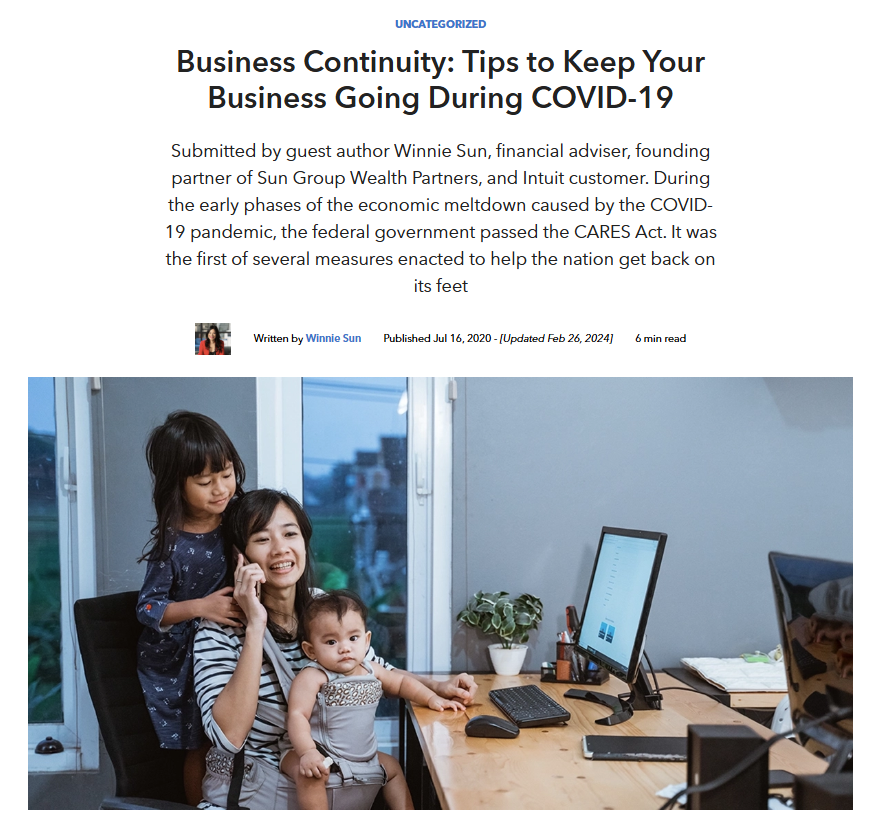

Here’s a good example of a guest post. Financial advisors Sun Group Wealth Partners has published an article about business continuity on accounting software provider Intuit’s website.

Sun Group and Intuit are likely to have similar audiences and this article is both valuable and interesting to them.

Niche Edits: Sometimes known as link insertions, this involves adding your link to existing content on relevant websites. This strategy works well because your link appears in articles that already attract traffic, improving your site’s visibility. Learn more about niche edits.

Broken Link Building: Identify broken links on financial websites and suggest your content as a replacement. This mutually beneficial strategy helps site owners fix their links while earning you a high-quality backlink. Check out this article for a detailed guide on broken link building.

Another backlink method is link insertion, meaning you reach out to include your link in an already-published piece on a finance-related site, which can boost your authority.

7. Improve your on-page SEO

On-page SEO chiefly involves adding keywords to parts of the page that Google is known to assess when ranking a page.

On-page techniques include:

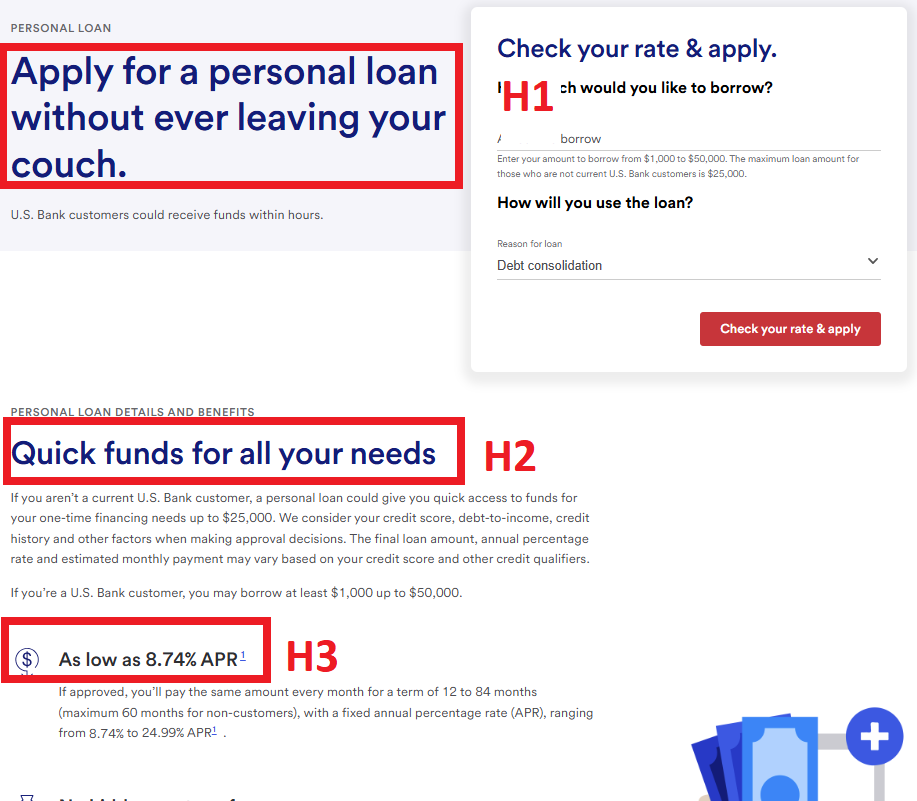

Optimize header tags: Use header tags (H1, H2, H3) to structure your content clearly. Include keywords in these tags to signal to search engines what your page is about and improve readability for users.

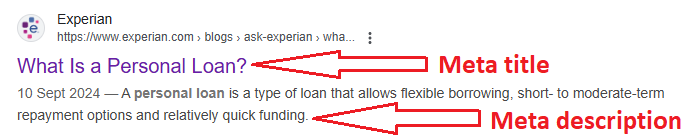

Write engaging meta titles and descriptions: Meta titles and meta descriptions are the headings and information you see in the Google Search results. Incorporate primary keywords into these and ensure they are compelling enough to attract clicks.

Use internal links effectively: Add internal links to connect related pages on your website, such as blog posts, service pages, or case studies. This improves site navigation for users and helps search engines understand the relationship between your pages.

Optimize image alt text: Alt text is used by search engines to understand what an image shows. Screen readers also read them out to users so they know what the image is. You should add descriptive alt text to all images. An example of alt text might be: “Financial advisor discussing retirement planning with a client.”

8. Hone your technical SEO

Technical SEO is the changes you make behind the scenes to your website. We already mentioned some of the most important technical SEO factors like mobile friendliness and Core Web Vitals in the audit section.

Some other common techniques to improve technical SEO include:

Improve website loading speed: Optimize your website’s load time by compressing images, leveraging browser caching, and using a content delivery network (CDN). Fast-loading pages reduce bounce rates and improve rankings.

Secure your website with HTTPS: Install an SSL certificate to ensure your site uses HTTPS. A secure site builds trust with users and meets Google’s ranking requirements.

Fix crawl errors: Crawling is when Google explores your site for new content. Indexing is when it adds your content to its directory of content. If your content doesn’t appear in Google’s index then it cannot be accessed via the search engine. Regularly check for crawl errors using tools like Google Search Console.

Submit an XML sitemap: Create an XML sitemap and submit it to search engines. This helps search engines discover and index all the important pages on your site. You can download website plugins to make a sitemap for you. Once you have one, go to Google Search Console, click “Sitemaps” in the menu bar and paste the sitemap URL into the prompt.

Implement structured data: Structured data is a way of organizing information on your website so that search engines can better understand it. It’s like adding labels to the content on your site to make it easier for search engines to identify important details. Add schema markup to highlight essential information such as your services, reviews, and contact details. Structured data can improve your visibility in rich search results.

Want to Dominate Search Results? Contact Authority Builders

SEO is essential to help financial services companies drive traffic, generate leads, and build trust with their audiences.

By continuously optimizing your website, creating valuable content, and building high-quality backlinks, you can enhance your online presence and stay ahead of the competition.

Ready to take your financial services SEO to the next level? Book a call with Authority Builders today and discover how our proven link-building strategies can help your business thrive.